Crypto millionaire sells more Ethereum for Bitcoin in a $70M-losing trade

A known crypto millionaire, active investor, trader, and Ethereum (ETH) supporter continues to capitulate from a losing Ethereum-Bitcoin (BTC) trade. James Fickel is among the richest cryptocurrency investors and a recognized entrepreneur in longevity research as the Amaranth Foundation’s founder.

In its most recent activity, Fickel swapped another 6,500 ETH for 235.6 wBTC in the Ethereum blockchain. This swap, currently worth around $22 million, is a partial close of the millionaire’s ETH long position against BTC.

According to SpotOnChain’s post, Amaranth’s founder has already lost approximately 22,000 ETH with this trade, worth over $70 million. His wBTC activity dates back from October 2023, supposedly when Fickel started his trades against the leading cryptocurrency.

Picks for you

Previously, Finbold reported two partial closes of the crypto millionaire’s Ether-Bitcoin trade – one in August and the other in September. The first happened as decentralized finance (DeFi) investors considered removing wBTC from Aave (AAVE) following BitGo’s partnership with Justin Sun.

James Fickel’s ETH-wBTC position and trades on Aave

Essentially, James Fickel is using a DeFi strategy to open long and short positions on spot, without using derivative contracts.

Through lending platforms like Aave, investors can supply digital assets to smart contract pools. Then, use these supplied assets as collateral to borrow other cryptocurrencies from other decentralized pools.

Therefore, an investor looking to long Ethereum against Bitcoin can supply ETH, use it as collateral to borrow wBTC, and use the borrowed tokens to buy more ETH in decentralized exchanges like Uniswap (UNI). If the ETH/BTC exchange rate increases, the trader can swap the purchased amount of ETH for wBTC, repay the debt plus the compounded interest rates, and pocket the profit in their preferred asset.

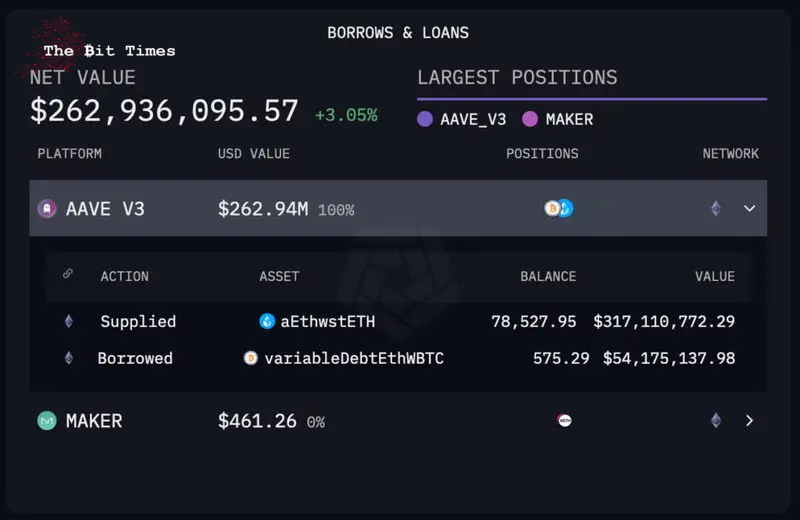

In fact, the millionaire’s position currently has supplied 78,527.95 ETH, worth $317.11 million, according to Arkham Intelligence. With this collateral, Fickel holds a debt of 575.29 wBTC, worth $54.17 million, which he has been repaying.

Ethereum vs. Bitcoin price, trades, and ETFs

James Fickel is not the only crypto millionaire adjusting his Ethereum positions from a bearish or more cautious stance. The crypto-native trading firm Cumberland recently deposited $55 million worth of 16,201 ETH to Coinbase, as Lookonchain reported today.

However, Wall Street traditional finance investors appear to be more bullish on ETH than on BTC. This is suggested by the two cryptocurrencies exchange-traded funds (ETFs) flows on Monday, with Ethereum leading with increased demand.

While “ETH ETFs had a net inflow of $130.8 million,” wrote Sassal on X, “BTC ETFs had a net outflow of $226.5 million.” This highlights the unpredictable and volatile dynamics in the crypto market, with millionaires placing their bets on future price action.

Featured image from Shutterstock.

Comments

Post a Comment