We asked ChatGPT-4o what’s next for Solana as SOL hits new highs

Amid the spotlight on Bitcoin’s (BTC) march toward $100,000 and the rising popularity of meme coins, Solana (SOL) has quietly solidified its position as one of the top-performing digital assets in 2024.

Over the past week, SOL has surged to $256, reflecting an impressive 45% weekly growth and reaching a record high of $264.50. This remarkable climb is not just riding on the broader market momentum but is also driven by Solana’s expanding ecosystem.

Adding to the momentum is the anticipation of spot Solana ETFs, which has ignited a wave of investor optimism, with AI-driven insights signaling the potential for even greater gains ahead.

Picks for you

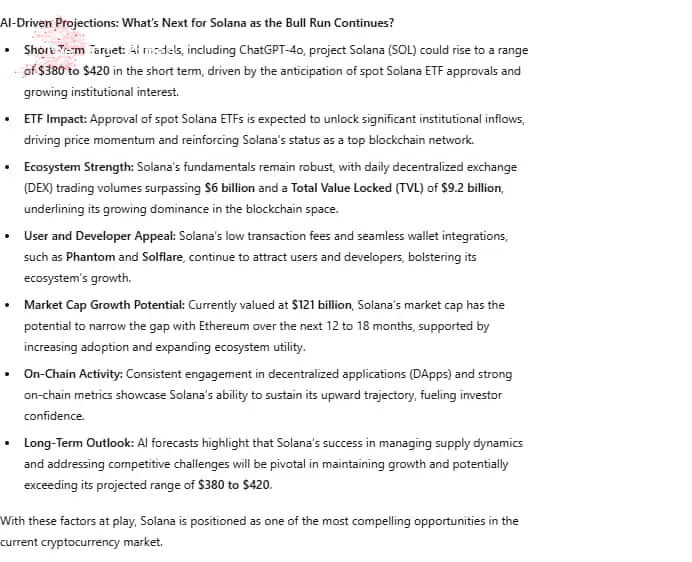

For a detailed Analysis of where Solana could head next, Finbold tapped into market data and sought insights from ChatGPT-4o to evaluate Solana’s prospects as it hits these new highs. The findings offer a deeper look into the key drivers behind SOL’s surge and its future trajectory in the evolving crypto landscape.

ETF optimism ignites Solana’s rally

One of the primary drivers behind Solana’s recent performance has been the growing anticipation of spot Solana ETFs. Major players like VanEck, 21Shares, and Bitwise have filed to list these ETFs on the Cboe BZX Exchange, coinciding with the resignation of SEC Chair Gary Gensler.

The leadership change has sparked hopes for a pro-crypto regulatory environment, which could accelerate ETF approvals. According to AI-driven projections, an approval could propel Solana’s price between $380 and $420, opening the floodgates for institutional capital and boosting the network’s adoption.

On-chain metrics highlight Solana’s strength

Solana’s on-chain activity underscores its growing dominance in the blockchain space. Over the past week, the network recorded more than $6 billion in daily decentralized exchange (DEX) trading volume, capturing an impressive 45% market share.

Additionally, Solana’s Total Value Locked (TVL) has surged to $9.2 billion, according to data from DeFiLlama, a sharp rise from $4.5 billion in July. Furthermore, Solana’s decentralized applications have seen record engagement, with 28.87 million unique active wallets interacting with its DApps in the past seven days.

AI-driven future projections

AI model, specifically ChatGPT-4o, provides a bullish forecast for Solana, projecting a potential surge between $380 and $420 if ETF approvals come through.

However, certain challenges could influence its trajectory. By mid-2025, Solana’s total supply is expected to increase, introducing potential capital swings and affecting price dynamics based on market demand.

Large-scale sell-offs could create downward pressure on prices, whereas strategic reinvestments into the ecosystem could support long-term growth, enhancing Solana’s overall market strength.

In summary, Solana’s current momentum positions it for new highs, with an ETF approval potentially accelerating its growth. However, the ability to sustain $250 support level will be crucial to determine the next trajectory.

Featured image via Shutterstock

Comments

Post a Comment